Marcin Malmon

MRICS REV

Szczerze o nieruchomościach

Equivalent Yield

From the arguments presented in the earlier posts on yields, one can conclude that a solution to provide an objective assessment of an investment transaction in terms of rate of return, where the contractual return differs from the market return, would be to do some averaging of the returns used in the analysis or to average the rate itself. A solution could be an equivalent yield, which is a weighted average of the initial yield of and the reversionary yield[1]. In mathematical terms, this is the internal rate of return (IRR). This is the rate that, when used both to discount the income flows from the property and to calculate the residual value of the property, will give a sum of discounted flows equal to the purchase price of the property.

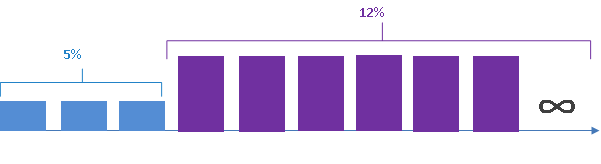

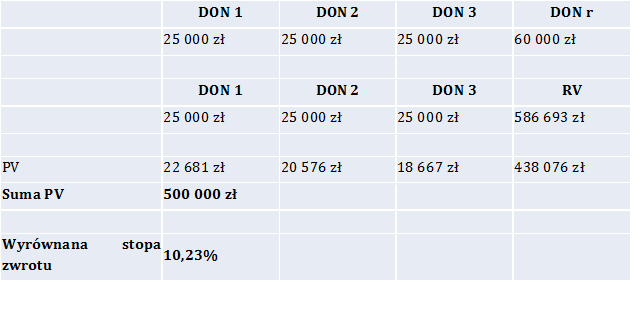

This yield can be determined by analysing a sales transaction that has occurred on the market using an Excel spreadsheet, using the ‘Goal seek’ function. So let’s try to determine the equivalent yield for a transaction of a hypothetical property with known cash flow and transaction price. This property will generate an annual contractual income of £25,000 for the next 3 years, while the current marketable income is £60,000. This property was sold for £500,000. The future income streams of this property can therefore be represented by the diagram below.

In relation to the recorded sale price, i.e. PLN 500,000, the contractual income will give a rate of return of 5% (25000zł/500000zł = 0.05 = 5%). In turn, the quotient of the market income to the transaction price will indicate a rate of 12% (60000zł/500000zł = 0.12 = 12%).

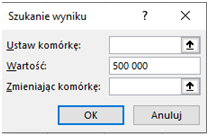

However, none of these rates adequately describe a property transaction with the yield pattern described above. We do know, however, that the correct yield on this transaction, taking into account the above profitability pattern (equivalent yield) is in the range 5% – 12% and is probably closer to its upper limit. To determine it straightforwardly, enter the data into Excel and use the “Goal seek” function. This can be done, for example, as follows:

Since we are guessing that the correct equivalent yield is close to the upper end of the range, we can start the ‘search’ at 11%.

After running the “Goal seek” function, a window will appear, allowing us to indicate the actual price of PLN 500 000, which Excel should obtain by changing the value of the cell in which we entered the initial 11%. In a fraction of a second, Excel will perform the operation indicating the precisely aligned rate of return on the analysed transaction of 10.23%.

It is worth bearing in mind that, despite the high precision with which the 10.23% rate was calculated, it reflects the pattern of profitability of the specific property under analysis, which in most cases will differ from the pattern found on the property being valued. For this reason, it will usually be necessary to make appropriate adjustments to the level of the resulting rate.

It should also be emphasised that the equivalent yield is defined as the rate which already reflects any expected future changes in market rental income over time (growth implicit yield[2]). This means that the cash flow analysed in this way should not include any subjective assumptions made by the investor or valuer regarding, for example, an increase in the level of rents on the market in a few years’ time, including after the expiry of current leases. Therefore, after their expiry, the results of the current market survey were used to calculate the residual value, without making any projections as to what this level might be in a few years’ time. Any changes in income levels over time here are a result of the provisions of the property leases and not projections of future market developments. This also applies to indexation, which for this reason is only taken into account during the term of the leases and after their expiry the rents are no longer indexed. Only changes occurring at the property itself and in the surrounding area are therefore reflected, but changes of a market nature are no longer taken into account. This type of cash flow is referred to as implicit cash flow.

It is absolutely fundamental, therefore, to remember that the equivalent yield can only be determined on the basis of a projection in the form of implicit cash flow and, therefore, when using it subsequently for the purpose of valuing another property, it too must be done using only a projection of income streams in this form.

It is absolutely fundamental, therefore, to remember that the equalized rate of return can only be determined on the basis of a projection in the form of indirect income streams and, therefore, when using it subsequently for the purpose of valuing another property, it too must be done using only a projection of income streams in this form.

You may be also interested:

[1] B. Crosby, „Definition of commercial property equivalent yield”, Financial Times

[2] ARGUS Valuation-Capitalisation ver. 2.50 Calculations Manual